Toda’s topic: “Tax Invoice Format“. Looking for an excel invoice format for the revolving of cash flows and counseling the circle of finances at the government sector, the government imposes various kinds of taxes to generate revenue. Therefore there are properly calculated tax invoices. These invoices are generated and issues to keep an accurate track of the amount deductions and their corresponding details.

Tax Invoice Format in Excel

For all different kinds and purposes of taxes, there are different kinds of formats and their procedural derivation including the basis of their calculations.

Tax invoices are usually issues from different organizations, banks and government departments over the deduction of due taxes on your activities.

Such as vehicle invoices are issued from excise departments, sales tax and income tax are issued from boards of revenues and similarly, savings tax and banking taxes are deducted from banks.

Now in order to maintain a standard understandable draft, there are devised invoice formats implemented all over the country. No matter what region you belong you, the same invoice with a taxpayer number is issued over the deductions of the amount.

Invoice Tax Category

Usually, taxes are imposed over the specific ration of a devised amount to be held for any activity. These taxes are collected by the corresponding departments yet are deposited at a central collection center which places all the tax revenues. So commonly the tax invoice formats are different for different categories of taxes.

For transport taxes, invoices are usually headed with the tax collection department, followed by the categories of various vehicles, their corresponding percentage of taxes and the specimen calculation of tax with all supporting details.

Similarly, for property tax, there are different categories of houses and their area wise tax imposition calculator is mentioned in the invoice. These categories are further aided with the decimal tax proportions and a fixed taxpayer number which is specified to each person.

Format for Excel Spreadsheet

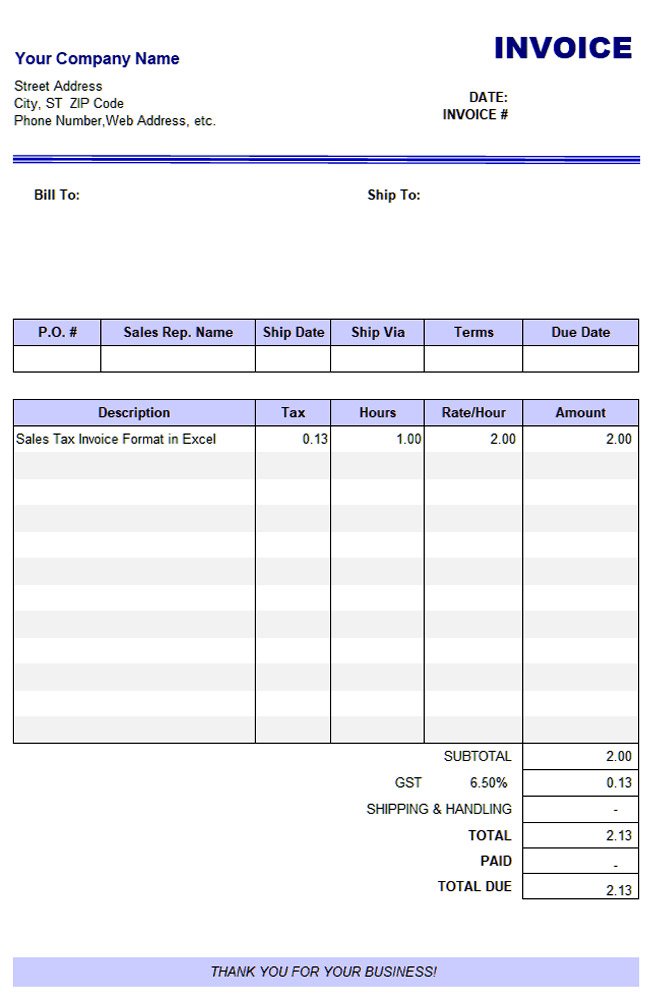

Excel spreadsheet is one marvelous tool for the rapid calculation and formulations based quick drafting of all kinds of invoices and financial documents. There are hundreds of formats of tax invoices available for Microsoft excel. Usually, there are the following steps being taken while drafting an invoice in Excel.

Header with the department’s name and detail of tax category in the below region

Categories of products or items are mentioned

Their relevant tax proportions are mentioned on alternate axis

The calculation is mentioned according to the requirement

Some of these amounts are mentioned in the end

Download Tax Invoice Templates

Template 1:

Filename: “tax-invoice-template”

File Size: 153 Kb

File Format: Ms Excel(xlsx)

Template Type: Basic (Free)

Download File: Comment Below to get free template *Mention Valid Email

Author Name: John Mathew

Template 2:

Filename: “tax-invoice”

File Size: 106 Kb

File Format: Ms Excel(xlsx)

Template Type: Basic (Free)

Download File: Comment Below to get free template *Mention Valid Email

Author Name: John Mathew

Template 3:

Filename: “tax-invoice-format”

File Size: 106 Kb

File Format: Ms Excel(xlsx)

Template Type: Basic (Free)

Download File: Comment Below to get free template *Mention Valid Email

Author Name: John Mathew

Format Varies Yet Enhances the Job

While writing financial documents, removing all kinds of minimal and maximum human errors and technical calculative errors should be removed in order to avoid any kind of financial disposition in the matters.

This job is made easier with the help of computer software applications and various tools which precisely stern out the exact amount which is relevant to the purpose. Tax invoice formats for excel vary according to the category yet they enhanced the job.

Please send all invoices

PLZ SEND 3RD TEMPLATE

please send third one

the invoice are simple and smart i like them all

pls send 3rd invoice

TEMPLATE 2